What Is the 4% Rule?

"A man is retiring and has saved a lot of money for retirement. How much money should he withdraw each year from his savings, so that his money will confidently last 30 years"?

If withdrawing too much, the money may not last his lifetime. If withdrawing too little, his hard-earned money is not best utilized to enjoy life.

Published in Journal of Financial Planning, 1994, financial advisor William P. Bengen provided an answer: withdraw 4% of the savings in the first year of retirement and adjust the withdrawals for inflation in future years. Then the chance of not running out of money in 30 years is about 90%. Mr. Bengen arrived at this conclusion after performing simulations using historical data on stock and bond returns over the 50-year period from 1926 to 1976, assuming a 50/50 portfolio (50% of the assets invested in stocks and 50% in bonds).

Here is how the 4% rule works. Suppose he has $2 million allocated to generate yearly retirement income. In the first year of retirement he withdraws 4% of that amount, or $80,000. In the second year of retirement, he adjusts his withdrawal amount for inflation. If the inflation rate is 2% in the previous year, he takes out $81,600 for the second year. He continues to take these yearly inflation-adjusted withdrawals over the course of his retirement for the rest of his life.

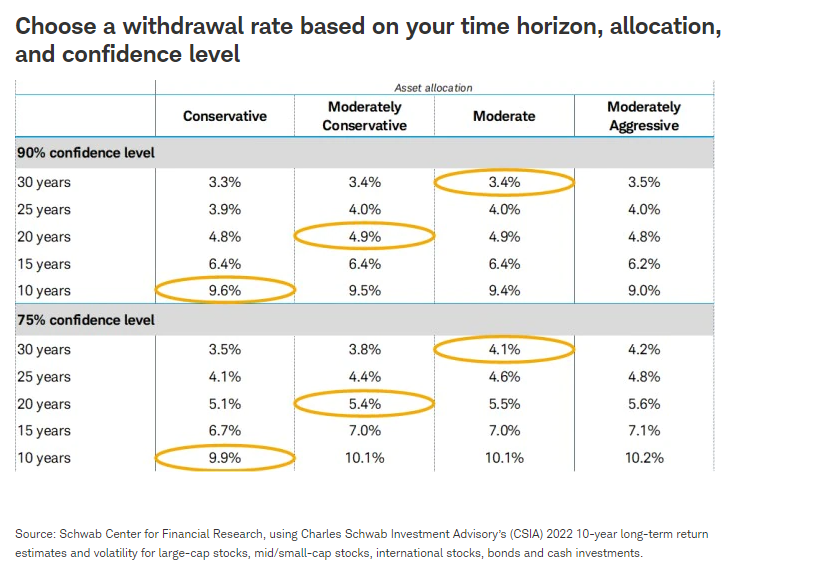

The 4% rule is a rule of thumb. It is meant to be used as a general guideline. Due to low interests in bonds, Morningstar lately did more simulations including recent stock and bond returns and suggested that a safe starting withdrawal rate be 3.3% in 2022, instead of 4%. This is consistent with Schwab's result for a conservative investor. Schwab further states that the initial safe (with a 90% probability of success) withdrawal rate can be 3.4% for a moderate investor and 3.5% for an aggressive investor.

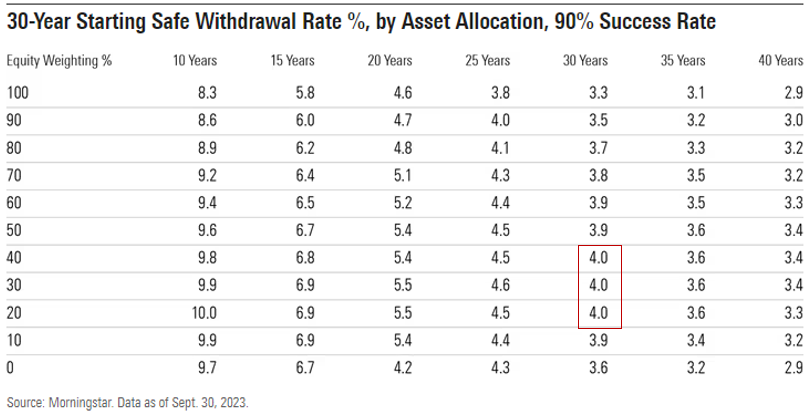

With the rising bond yields, as of September 2023, Morningstar improved the safe withdrawal rate to 4% for a diversified portfolio with 20% to 40% stocks. Note that having more stocks may not be better in retirement income planning. With 100% of the portfolio invested in stocks, the safe withdrawal rate decreases to 3.3% for a 90% success rate and 30-year time horizon.

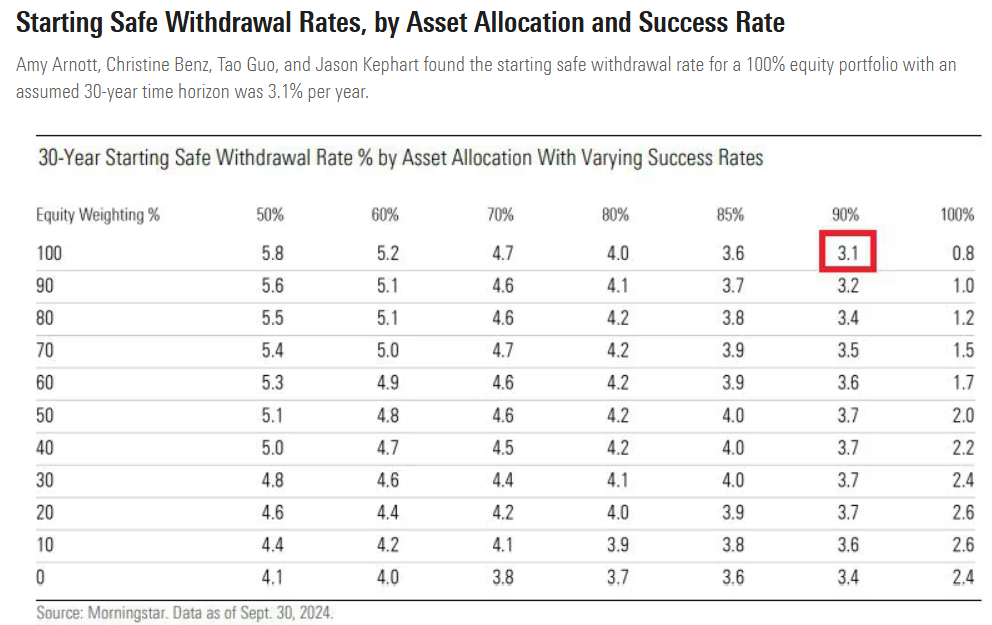

For 2025, the safe withdrawal rate with 100% in stocks decreases even further to 3.1%. It is 3.7% for a diversified portfolio with 20% to 50% in stocks.

The Sequence Risk

The harsh reality of the 4% rule and the sequence risk is this. Two people retire in different years, but have saved the same amount of money for retirement, and both follow the 4% rule with exactly the same starting withdrawal rate. Due to the sequence risk, they could end up with one being successful but the other running out of money prematurely.

Can We Do Better Than the 4% Rule?

If an investor manages his money himself, the 4% rule is easy to use. But it is not guaranteed to be successful in having the money last his lifetime. He may still face the risk of running out of money prematurely. As a retiree grows older, his portfolio would shift more towards bonds, while bond yield is historically low. This would put more pressure on his retirement income and on maintaining the same purchasing power due to inflation. The question is: can he reduce the sequence risk, improve his success rate, and get more income to spend each year than what the 4% rule gives him? The answer is yes, but with the help of a qualified professional. We will be happy to help with your retirement income planning.

Some Articles from Reputable Sources

The following articles may help you understand what the 4% rule is and what main issues it is aimed to resolve. It is critical to understand its pros and cons. If not done correctly, your retirement could be ruined, or not as enjoyable as it should be. Seeking professional help early is recommended.

This page is for general information only and is not intended to provide specific advice

for any individual.